The (often ignored) role of physical security in protecting business value

In the world of mergers and acquisitions (M&A), the focus of CEOs, CFOs, advisors, and investment funds is understandably on economic indicators, strategic assets, operational synergies, and tax optimization.

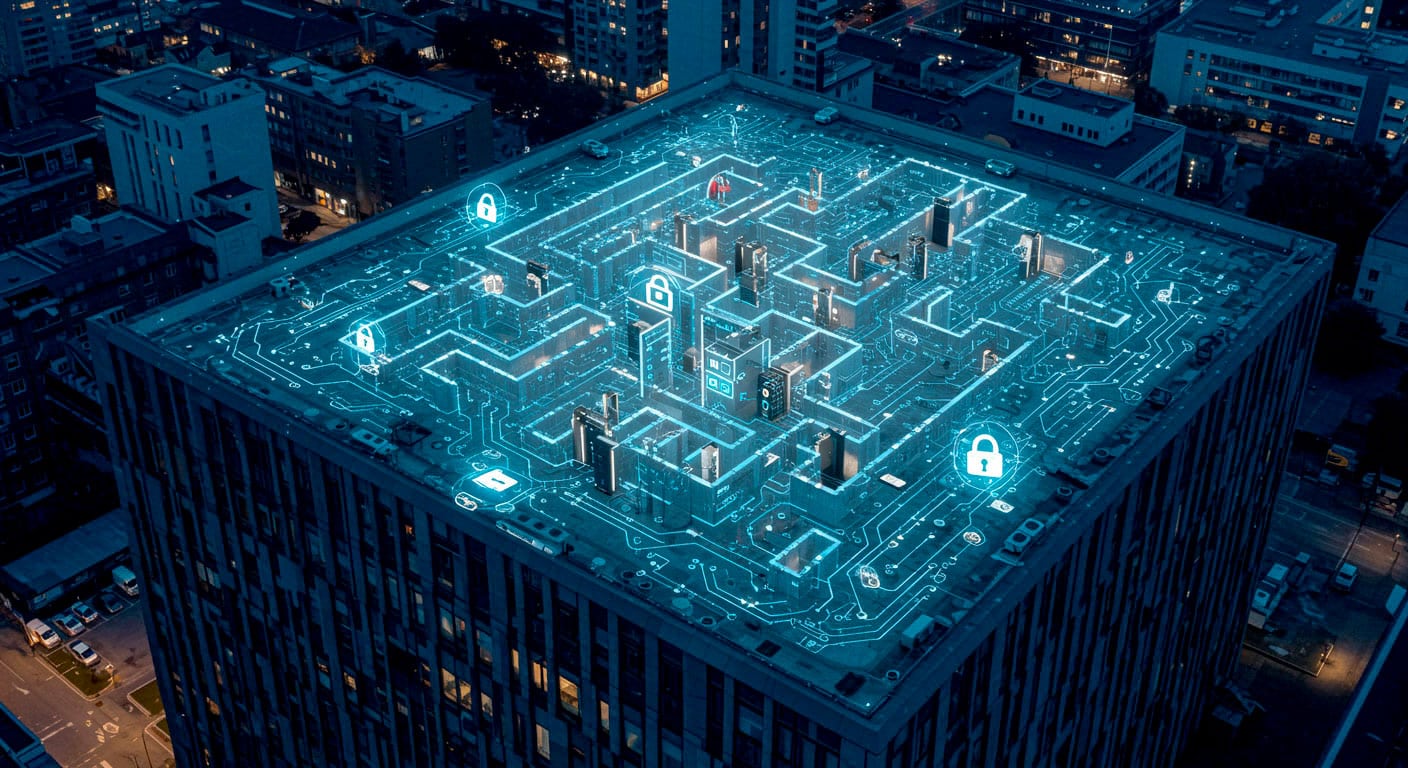

However, there is one critical element often overlooked in due diligence: physical corporate security.

Precisely at the most sensitive transition stages-pre-acquisition, closing, and post-deal integration-is when physical security should be a strategic lever to protect the value of the investment.

The invisible threat: what can happen without physical control

When a company changes ownership, the risk of operational security holes increases significantly. Some critical scenarios that have actually occurred in M&A transactions:

- Sabotage or misappropriation of physical assetsbydisgruntled employees or former collaborators prior to closing.

- Theft or duplication of confidential documentation, especially contracts, patent assets, business plans.

- Unmonitored or unrevoked accessby personnel who should no longer have active credentials.

- Loss of control over security, surveillance, or facility providers, often outsourced.

- Conflicts and fragility in access control systems when the companies to be integrated use different technologies or protocols.

These events, though rare, can seriously impair the value of the operation, delay integration, or-in the most serious cases-lead to litigation or reputational damage.

Why physical security must be part of due diligence

Many funds, investors or buyers structure thorough due diligence from tax, legal and business perspectives. However, physical security is rarely included in the documents analyzed.

Instead, a structured Security Due Diligence can highlight:

- Any vulnerabilities in access control, video surveillance or alarm systems.

- The presence of non-contracted or non-compliant suppliers.

- Abnormalities in the flow of people, goods, or information.

- Any internilegated risksto former employees or outgoing key figures.

- Gray zones in themanagement of physical and technological supervision.

The most delicate moment: post-acquisition integration

After the deal is signed, the most complex phase begins: converging two corporate structures, two organizational charts, two governance models. In this phase:

- A physical security unification plan is needed.

- It is essential to centralize or harmonize access control and protocols.

- A new chain of command must be defined for security(with roles, responsibilities, escalation).

- Security, surveillance and technology providers need to be evaluated and supplemented or replaced.

Who should care (and when)

The involvement of Security Managers and Facility & Risk Managers should begin before closing. From a governance and prevention perspective, CEOs and CFOs should also pay attention to:

- How the target company’s physical security is structured.

- Whether there are “dormant” risks that could explode at the moment of maximum vulnerability.

- How to ensure operational business continuity even during the transition of ownership.

Operational checklist: physical security in M&A transactions

Here are the 5 priorities to consider to protect the value of the operation:

- Due Diligence in security

Assess the status of video surveillance systems, access control, and emergency procedures. Identify vulnerabilities that might emerge in the post-deal phase. - Mapping critical assets

Locate locations, plants, archives and sensitive areas. Verify who has access and whether weaknesses exist in the physical garrison. - Managing access during transition

Suspend or update obsolete credentials, control physical and digital access, define rules for visitors and vendors. - Enhanced surveillance at critical moments

Strengthen physical presence and monitoring in the days before and after signing. Specifically monitor warehouses, documents, and production lines. - Post-deal audit and harmonization

Align security policies among the companies involved. Review supervisory contracts, train staff, unify protocols and tools.

Conclusions

Investing in physical security in an M&A context is not a cost, but a protection of the investment.

Integrating a physical assessment into the pre and post-deal phases allows you to reduce operational risks, protect strategic assets, ensure continuity and preserve the economic, industrial and reputational value of the deal.

A modern view of corporate security must also include these critical moments. And for those leading an acquisition or merger, prevention today means savings tomorrow.